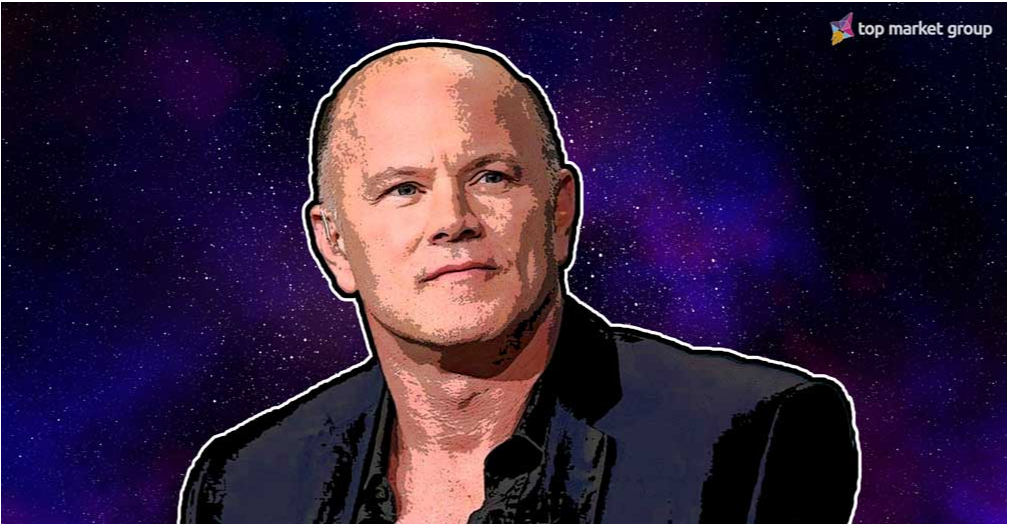

Mike Novogratz’s crypto investment bank Galaxy Digital is increasing its services to supply crypto options contracts trading, business media outlet The Block reports on June 21.

According to the report, Galaxy Digital’s new initiative is formed in response to increasing demand from institutional investors so as to hedge the high volatility that's a job card of crypto assets.

Bitcoin (BTC) options are a sort of crypto by-product that is a wide-spread methodology of profiting from an extremely volatile market by strategically hedging risks like reducing portfolio risks, and successively, losses from trading. the same as traditional finance, there are 2 kinds of crypto choices which will be bought — decision options and place options. severally, these translate to the right to buy and right to sell the holding at the determined worth.

Yoshi Nakamura, international head of business development at Galaxy Digital, reportedly claimed that crypto-related businesses like mining corporations and lenders are expressing a lot of interest to crypto options recently. However, the manager declined to reveal specific numbers concerning the growth of the business, adding that Galaxy’s crypto choices business is “relatively new.”

According to an executive from crypto investment company BlockTower Capital, the demand for crypto choices has been increasing so, that is primarily driven by non-crypto corporations.

According to the report, Galaxy is not thesole firm in providing crypto choices, with the service being reportedly supported by over-the-counter (OTC) mercantilism operators like Akuna Capital and Cumberland, the Chicago-based cryptocurrency trading unit of DRW Holdings LLC.

As reported earlier today, high volatility is that the biggest reason individuals give up on cryptocurrencies, accounting for thirty-first of answers from those polled on why they stopped using crypto.

Meanwhile, BTC futures, that is another variety of crypto derivatives, have in brief broken $10,000 mark today on the Chicago Mercantile Exchange’s (CME).

To know more on Cryptocurrency and Blockchain events, follow us on Facebook, YouTube, Twitter, LinkedIn, Reddit, Telegram, BitcoinTalk, and we are also on Medium now